How do I make (and follow) an easy budget?

I am so excited to chat about all the budget things in this post!

This is a topic I’ve never written about, which is crazy because it’s something I’m so passionate about and talk about all.the.time.

I thought it might be helpful to write everything down in one place, since I get questions on this topic every time I talk about it in my Instagram stories.

Even if this only helps one person, or one couple, it will be worth sharing this info!

Before we get going, let me just say that I understand if your blood pressure is rising just at the thought of talking about money. It can feel very overwhelming and cause you to bury your head in the sand, ignoring all the problems.

If you can pop your head out for just a few minutes, you might find that it’s easier to get started than you thought it might be. :)

One of my favorite Saturday morning activities is looking through my emails from 20+ years ago to read over our monthly budget when we were first out of college and first married. It’s beyond entertaining.

It is fascinating to see how we lived off of mere pennies each month, and how our apartment rent was less than $600. Excuse me?!??

The very first budget I can find in my email is dated August 31, 2005. My income was about $1000/month from 3 separate jobs while working as a full-time student.

My car payment was $100, my cell phone was $65, food was $60, and gas was $80 a month. I feel like I should add that I budgeted $10 a month to make Shutterfly photo gifts. Ha!

I also love looking over our wedding budget from 2006. We got married pre-Instagram and pre-Pinterest. There wasn’t as much pressure on us to make our wedding look “social media worthy.” Although, it was still the most beautiful day, in my book.

We were able to get married and go on our honeymoon for less than $5,000.

But also, our honeymoon was spent in the Appalachian Mountains in a cabin for $25 a night.

In 2009, we were both well into our professional teaching jobs, so our income increased, but lifestyle inflation did as well. Our debt category accounted for more than 20% of our income, while our savings was less than 4%.

It would take another 10 years for us to flip these two categories, allowing us to live off of 77% of our salary instead of the 100% we’d been used to for so long.

When thinking about how to create a budget, I can tell you I have tried every program ever created. If it’s out there, I’ve tried it.

For the last few years we landed on everydollar.com, which worked for a while, but it was challenging for me to keep it updated.

I’ve tried other digital platforms, keeping a budget on paper, cash envelopes, and other methods. Some of them worked better than others for us.

I think it’s important to note before going further that everyone is different and the tool I’ve landed on may not work for you.

But, don’t give up. Keep working at it. Your future self (your retiring self) will thank you.

I’ve finally found a process that works well for me, and I will talk about it to anyone who is willing to listen.

As many of you probably know, we get tons of Instagram and Facebook ads pushed to us every day. One of the ads I kept seeing day after day was a budgeting spreadsheet by Abby Lawson.

I had been thinking about trying a new method for a while, and thought I could make my own spreadsheet. However, about five minutes into it, I realized I was not as “proficient” with Google Spreadsheets as I’d made it sound on my resume.

I decided to pay the dumb $12 for a spreadsheet that was ready to go and just move forward.

That $12 one time fee has paid itself off ten times over in my book. It’s so simple and has saved me so much time and mental energy (anguish) that I used to spend on other budgeting software programs.

If you don’t know where to start, or if you’ve never used a budget before, I highly recommend trying this one out. Obviously, this isn’t sponsored…I just really like this method and I wanted to share!

It takes about 5-10 minutes to setup your income, savings, bills, etc., and then you’re ready to go!

If you’ve heard me talk about budgeting before, you’ve probably heard me say that I have 14 checking accounts. Yes, fourteen. That may seem outrageous to some people, but let me explain.

Several years ago, we found ourselves in credit card debt due to the fact that we didn’t have a sufficient emergency fund. Things were going well until we hit a month where there was a home emergency, a car emergency, and a pet emergency all in one month.

Enter credit cards.

What we’ve learned since then is that most of the “emergencies” we were putting on credit cards weren’t emergencies at all; they were unbudgeted items.

When there’s a $500-$1,000 “emergency” every month, that isn’t an emergency. That’s a saving issue.

That realization really spurred us on to beef up our savings accounts. We paid off the credit cards as quickly as possible and then focused on our savings.

I’m sure the next question you’re probably wondering is…how do I save if I don’t have any money left at the end of the month?

The answer is pretty unpopular and not fun at all.

Live below your means.

If you make $5K, $10K, or $15K a month, you’ll never be able to save as much as you need if you live off of every single dollar that comes in.

For us, this looks like living off of 77% of our salaries. When we get paid, I immediately pay myself into my 14 savings accounts as if they are BILLS I have to pay.

We don’t wait until the end of the month to see if there’s anything left. We save it up front.

The beauty of this is when a home emergency, or a vet bill, or Christmas comes up, we can transfer the money and move on.

It makes me giddy every time we’re able to buy new tires and wheels for both of our cars in one month in cash (like we had to do last month) because I vividly remember the feeling of having to go deeper into debt for those things before I started saving.

Thinking about savings can be scary and really daunting. I know we don’t have kids, and if we did, we’d have to dedicate a huge chunk of our income to them. However, I will still make a claim for savings for all family types - the more people you’re responsible for, the more unexpected the expenses could be. It is not if, but when, an emergency will hit. Even if it’s just $100 a month, it’s so important to live below your means and save as much as you can.

To give you an idea, here are some of the checking accounts we pay into:

Christmas - Decide how much you want to spend at Christmas, divide it by 12, and save that amount each month. In December, transfer that amount into your checking account and thank your past self for saving up!

Home - Be sure to have your insurance deductible in savings if you own your home. In this account, I also save any amount I didn’t use of electricity and water for the month. In other words, I pretend that my water and electricity will cost $450 a month every month. When the bills aren’t that high, we don’t use that money…we save it so we have extra in the summer when the bills are even higher.

Taxes & HOA Fees - Look at how much you’ve paid on taxes over the last few years, divide it by 12, and save that amount each month so you have plenty to cover next year’s taxes. Same for HOA fees, if this applies to you. Our fees are due on Jan 1st every year, so we save a certain amount each month and then pay the bill Jan 1st.

Vacation - This is a huge one for us and something we’ve always prioritized, even when we first got married. Since we both used to be teachers and had the summers off together, I wanted us to be able to do fun stuff in the summer! This meant we needed extra money. Even if it’s only $50 a month, save it!

Medical - One of the best financial decisions we ever made was when we moved to a new tier in our employer’s insurance plan. It would save us $900 a month ($450 for each of us) to move to the option where we had to request referrals from our PCP to visit other doctors. While this is a temporary hassle, it was a huge blessing. We made a commitment to not move the $900 into other budget categories; we would save this money into our own medical savings account to cover upcoming dental work and medical expenses. This decision has been a game changer for our family!

20 Year Trip - Our 20 year anniversary is coming up in two years (from today!) In addition to the money we save for vacation every month, I also plan to save an extra chunk of money each month to make up for the amount we need for a more extravagant vacation (like Hawaii or Italy.) I calculated what I would need in addition to our annual savings, and then divided that by the 24 months I will be saving.

The other accounts I save into are: my fun money, Brian’s fun money, emergency fund (will eventually hold 3-6 months of our expenses), car savings (for repairs and car replacement), Jackson Ridge (our Oklahoma land - for construction projects), dog savings (unexpected vet bills and grooming appointments), and pest control savings (paid quarterly).

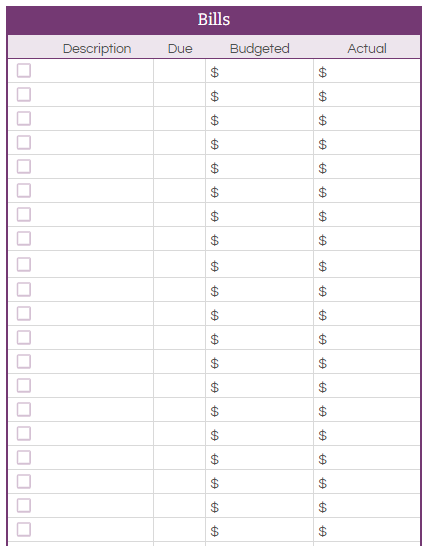

Now that we’ve tackled savings, let’s look at the “Bills” category.

You’ll want to input any bills that are a fixed amount- electricity, water, mortgage or rent, Netflix, tithe, etc. Enter the amount under “budgeted” and then once the bill clears from your bank, enter the final amount in the “actual” column and click the check mark.

The “Variable Expenses” category will include things like: gas/tolls, groceries, home needs, eating out, entertainment, prescriptions/office visits, etc. These are things that fluctuate every month, or “vary,” hence the name.

Under “Debt,” you’ll want to list out any debt payments you make every month. We still have Brian’s truck payment listed under Debt, but once that is paid off, we will only have our mortgage. That will be an amazing day!

Once you pay off more debt, you can funnel that money into beefing up your savings accounts! It will be tempting to begin using this money in your regular budget, but if you have the discipline to move this into savings or investments, it will pay off later. Literally.

Now all you have to do is spend less than five minutes a day adding any expenses to the bottom of the spreadsheet under “Variable Expense Tracker.” Since you set your categories at the top, you’ll be able to select them from a drop down as you enter them in.

Of course, setting up the budget is only a small part of the process. The hard part is having the discipline to follow it and live below your means so you can increase your savings and investments!

One final tip: Add “update budget spreadsheet” to your daily to do list so you don’t forget to update it every day. I find that it takes much less time to update it each day than to wait until the end of the week to enter every expense.

Happy budgeting! Need help or more specific advice? I’d love to chat!

I’m so glad you’re here, friend. I’m not sure how you found this post, but I continue to be amazed by the internets. It brings us together in such beautiful ways and reminds us that we’re more alike than different. More united than divided. Whether you spend a minute or an hour on this page, know that Jesus loves you like crazy. Like CRAZY. I’d love to hear how I can pray for you. Would you let me know here?